Signs of a developing bull market could continue to boost Bitcoin prices despite the tense atmosphere of the US trade war.

Bitcoin (BTC) sought higher levels around the Wall Street open on April 11 as the week’s final US inflation data gave hope to bulls.

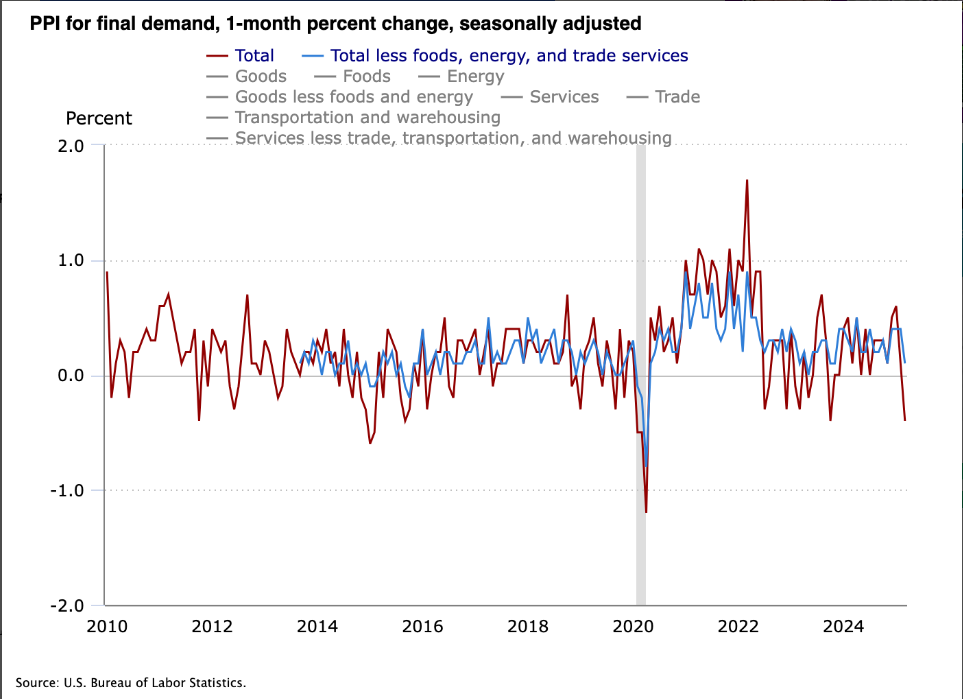

Analyst: Below-target PPI 'excellent' for US trade war

Data from Cointelegraph Markets Pro and TradingView showed the BTC/USD pair hitting highs of $83,245 as US Producer Price Index (PPI) data came in below expectations.

The index stood at 2.7% compared to the expected 3.3%, while the core PPI also surprised on the downside.

An official statement from the US Bureau of Labor Statistics (BLS) added:

“In March, more than 70% of the decline in the final demand index can be attributed to the prices of final demand goods, which fell by 0.9%. The final demand index for services fell by 0.2%.”

The Kobeissi Letter was among those that pointed out the rapid pace at which US inflation appeared to slow.

“We have just seen the first month-on-month decline in PPI inflation, -0.4%, since March 2024,” he told his followers in part of a post on X.

“Both CPI and PPI inflation have dropped SHARPLY.”

However, the behavior of risk assets did not reflect the theoretically positive evolution of inflation. The S&P 500 was down 0.2% on the day, while the Nasdaq Composite Index was flat.

As Cointelegraph reported, after stocks fell precipitously the previous day despite bullish inflation numbers, commentators explained that the macroeconomic data was helping fuel the ongoing US trade war.

Cryptocurrency trader, analyst and entrepreneur Michaël van de Poppe saw a repeat after the IPP.

“The PPI comes in significantly lower. That’s great for Trump and his strategy,” he argued, referring to the trade tariffs implemented by US President Donald Trump.

“The only thing that needs to be resolved is the ongoing Trade War, but the ingredients are piling up.”

Bitcoin receives the key bullish trigger for the dollar

Another macro development that did not provide your standard risk asset tailwind came in the form of multi-year lows in US dollar strength.

The US Dollar Index (DXY), which measures the dollar against a basket of US trading partner currencies, fell below the psychological 100 mark for the first time since 2022.

As Cointelegraph reported, long-term lows in DXY have historically sparked a delayed bull run in the price of BTC.

“Traditionally, DXY going down is very bullish for $BTC, we now have a massive bearish divergence for DXY, which may suggest it is going to 90,” noted popular crypto analyst Venturefounder in part of an X post on the topic this week.

“The last 2 times this happened it triggered a parabolic Bitcoin bull run in the final phase of the bull market (which lasted 12 months).”

An accompanying chart examined the Relative Strength Index (RSI) data from the DXY’s monthly chart, showing that it retested a downtrend line as support from above.

As we always say, the future is in cryptocurrencies, but however you must prepare very well to be able to enter this world and take advantage of it, we invite you to be part of the FOXXXER family, where you will learn how the market behaves and when is the best time to operate. Here is your DEV reporting the best and latest news, see you FOXXXERS!